Q&A with CEO Jim Prokopanko

A conversation on our progress and commitment to sustainability

Our Growth in Brazil

Supporting the production of crops through crop nutrition

Companywide Innovation

Taking the lead in market, product and industry practices

Leadership & Awards

Strengthening our transparency & commitments

Year-Over-Year Comparative Highlights

Details on 2010 through 2013 financial and non-financial performance.

Goals & Progress

An update on goals developed in 2012

Economic Performance

EC1

Direct Economic Value Generated and Distributed, Including Revenue, Operating Costs, Employee Compensation, Donations and Other Community Investments

| Economic Performance (in millions) |

|||||

|---|---|---|---|---|---|

| FY 2010 | FY 2011 | FY 2012 | FY 2013 | CY 2013 | |

| Revenue | $6,759.10 | $9,937.80 | $11,107.80 | $9,974.10 | $9,021.40 |

| Operating Costs | |||||

| Cost of Goods Sold | 5,065.80 | 6,816.00 | 8,022.80 | 7,213.90 | 7,006.00 |

| Selling, general and administrative expenses | 360.30 | 372.50 | 410.10 | 427.30 | 393.50 |

| Less: Unrealized gain/loss on derivatives | -71.30 | -13 | 41.90 | -15.20 | -0.40 |

| Less: Depreciation, depletion and amortization | 445 | 447.40 | 508.10 | 604.80 | 655.60 |

| *Less: Wages and benefits | 494.10 | 772.30 | 843.10 | 935.90 | 927.80 |

| Total Operating Costs | 4,558.30 | 5,981.80 | 7,039.80 | 6,115.70 | 5,816.48 |

| Wages and Benefits | 494.10 | 772.30 | 843.10 | 935.90 | 927.80 |

| Payments to Providers of Funds | |||||

| Dividends Paid | 668 | 89.30 | 119.50 | 426.60 | 427.10 |

| Interest paid (net of amount capitalized) | $60.00 | $43.10 | $21.00 | - | $6.90 |

| Total Payments to Providers of Funds | 728 | 132.40 | 140.50 | 426.60 | 434 |

| Retained Earnings | 5,905.30 | 8,330.60 | 10,141.30 | 11,603.40 | 11,182.10 |

| Tax (Payment to Government) | |||||

| Taxes Paid (Refunds Received) | |||||

| U.S. | -183.60 | 264.70 | 272.70 | 175.80 | 155.10 |

| Canada | 608.20 | 132.10 | 211.90 | 123.20 | 107.60 |

| Brazil | 7.20 | 4.10 | 2.20 | 2.90 | 3 |

| Other worldwide | 56.70 | 134.30 | 29.60 | -2 | -0.20 |

| Total Income Taxes Paid | 488.50 | 535.20 | 516.40 | 299.90 | 265.50 |

| Canadian Resource Taxes and Royalties Expense | $127.90 | $294.20 | $327.10 | $307.90 | $235.20 |

| Note: (*) Mosaic Cost of Goods Sold and Selling, General and Administrative expenses from the 10K include wages and benefits. For the GRI report, wages and benefits are requested separately, so they are excluded here and added back in as a separate line item directly below. | |||||

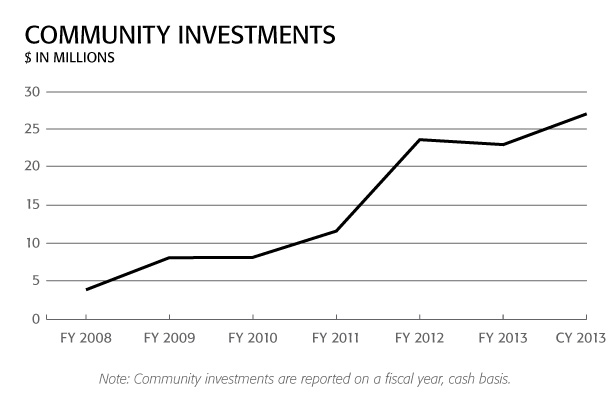

Community Investments

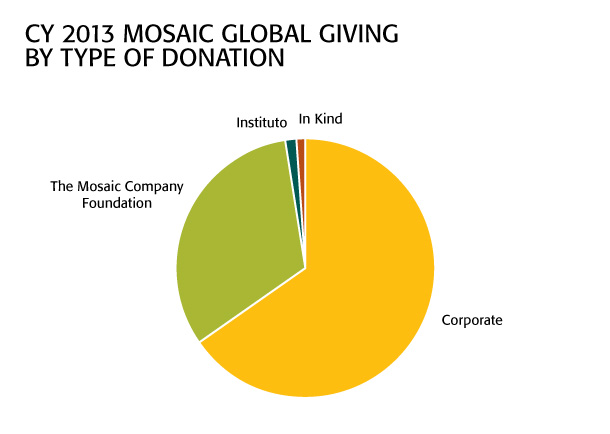

In 2013, Mosaic targeted to invest 1% of earnings before interest and taxes (EBIT) over a three-year rolling average into our communities. The Mosaic Company, The Mosaic Company Foundation and The Mosaic Institute in Brazil make investments in our global communities through philanthropic funding, employee engagement and in-kind donations. Combined contributions in 2013 reached $27.16 million.

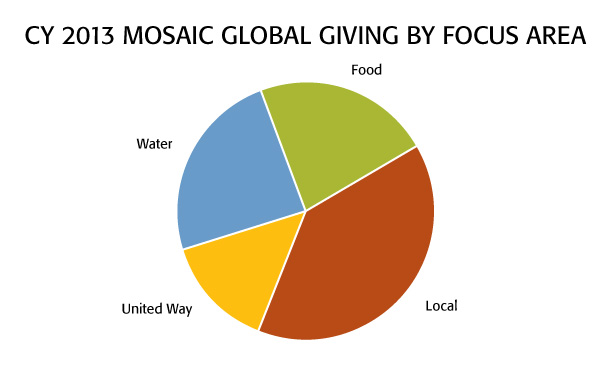

Mosaic focuses its community investments in three areas:

- Food: hunger relief, agricultural development, and agricultural research and education

- Water: Watershed restoration, habitat conservation and nutrient stewardship

- Local: Philanthropic or civic partnerships that enrich the long-term strength of communities in which Mosaic has offices and operations

The graph above reflects investments made in communities where targeted beneficiaries are external to the company. This may include contributions to research institutes unrelated to Mosaic’s research and development activities, funds to support community infrastructure and other philanthropic efforts.

EC2

Financial Implications and Other Risks and Opportunities for the Organization’s Activities Due to Climate Change

Mosaic’s 2012 published “Commitment on Climate Change” states that global climate change creates uncertainty for our business and poses challenges for the health and well-being of the world’s populations – ecologically, socially and economically. The potential financial implications with regard to the physical changes associated with climate change, as well as potential regulatory response changes, are discussed in Mosaic’s CDP public response and in Mosaic’s 10-K Report. We evaluate whether, and to what extent, environmental issues and associated regulations could adversely impact our costs and operating activities, as well as the supply, demand, cost and location of grain production. This evaluation is part of a broader strategic business plan designed to help Mosaic meet or exceed production and profitability requirements. Other aspects of this plan include strategies for lowering purchased energy consumption through more efficient processes and maximizing the use of energy generated through the fertilizer manufacturing process.

Risks and Opportunities Driven by Physical Changes

Changes in temperature, drought, floods, storms and plant disease could affect agricultural production and negatively impact the demand for crop nutrient products. The effects of these impacts could be material to Mosaic. Mosaic’s balanced approach to crop nutrition is a strategy to mitigate the adverse effects of drought, floods, storms and plant disease. We have established relationships with key universities and research organizations around the globe to develop and test innovative products like the MicroEssentials® product line, which is designed to help farmers make the most of every inch of farmland.

The same physical changes could result in an increase in demand for Mosaic’s higher yield crop nutrition products, which could have a positive effect on our operating results and financial condition.

Risks and Opportunities Driven by Regulatory Changes

While there is uncertainty with regard to what final material regulatory provisions and targets applicable to Mosaic will be adopted in reducing greenhouse gases (GHG) in the United States and Canada, if any, the commitment by federal, province-based (Canada) and state-based (United States) regulatory bodies is in motion. Any agreement, regulation or program that limits or taxes direct and indirect GHG emissions from our facilities could increase operating costs directly and through suppliers.

These initiatives could restrict our operating activities; require us to make changes in our operating activities that would increase our operating costs; reduce our efficiency or limit our output; require us to make capital improvements to our facilities, increase our energy, raw material and transportation costs or limit their availability; or otherwise adversely affect our results of operations, liquidity or capital resources. Any of these costs could be material to Mosaic. In order to manage the potential risks from changing regulations, Mosaic is taking a proactive approach, with particular emphasis on improving energy efficiency and waste management. These initiatives will assist Mosaic in emission reduction.

Any change in regulation that incentivizes production and/or use of renewable energy could provide a variety of opportunities to Mosaic, many of them with financial benefits. Similarly, if climate change-related restrictions were global in nature, Mosaic could gain a competitive advantage over our global competitors due to our current environmental performance and/or planned performance and initiatives related to environment and greenhouse gas emissions.

See Mosaic’s 2013 Carbon Disclosure Project response for more information on Mosaic’s efforts to address the risks and opportunities associated with climate change.

EC3

Coverage of the Organization’s Defined Benefit Plan Obligation

Please refer to Mosaic’s 10-K Report (page 137, F-74).

| Benefit Plan Obligation (in millions) |

||||

|---|---|---|---|---|

| FY 2011 | FY 2012 | FY 2013 | CY 2013 | |

| Pension Plan Obligation: | $694.30 | $743.30 | $788.60 | $728.00 |

| Fair Value of Plan Assets | $630.00 | $654.40 | $707.60 | $736.90 |

| Pension Plan Asset Allocation | ||||

| U.S. Pension Plans | U.S.-Pension Assets as of 5/31/2011 | U.S.-Pension Assets as of 5/31/2012 | U.S.-Pension Assets as of 5/31/2013 | U.S.-Pension Assets as of 12/31/2013 |

| Fixed Income | 75% | 77% | 74% | 75% |

| U.S. Equity Securities | 12% | 11% | 13% | 12% |

| Non-U.S. Equity Securities | 7% | 6% | 7% | 7% |

| Real Estate | 4% | 4% | 4% | 4% |

| Private Equity | 2% | 2% | 1% | 2% |

| Other | 0% | 0% | 1% | 0% |

| 100% | 100% | 100% | 100% | |

| Canadian Pension Plans | Canadian Pension Assets as of 5/31/2011 | Canadian Pension Assets as of 5/31/2012 | Canadian Pension Assets as of 5/31/2013 | Canadian Pension Assets as of 12/31/2013 |

| Fixed Income | 28% | 38% | 37% | 38% |

| U.S. Equity Securities | 24% | 22% | 21% | 22% |

| Canadian Equity Securities | 23% | 21% | 20% | 21% |

| Non-U.S. Equity Securities | 15% | 14% | 14% | 14% |

| Private Equity | 3% | 3% | 2% | 2% |

| Other | 7% | 2% | 6% | 3% |

| 100% | 100% | 100% | 100% | |

| Investment Plan and Savings Plan | FY 2011 | FY 2012 | FY 2013 | CY 2013 |

| Attributable Expense | $28.50 | $30.00 | $34.50 | $35.20 |

EC4

Significant Financial Assistance From Government

In Canada, tax credits for FY 2013 were as follows (reported in U.S. dollars):

- Research & Development Credit = $6.3M

In the U.S., tax credits for FY 2013 were as follows:

- Research & Development Credit = $2.75M

- Agricultural Chemicals Security Credit = $15,000

- Mine Rescue Team Training Credit = $43,000

In Brazil, tax relief and credits for CY 2013 were as follows (reported in U.S. dollars):

- Employee Meal & Leave Subsidies = $191,298

- Freight Tax Reduction – SUDENE = $35,917

Market Presence

EC5

Range of Ratios of Standard Entry-Level Wage Compared to Local Minimum Wage at Significant Locations of Operations

Mosaic offers competitive compensation and benefits in each of the company’s significant locations of operation. As noted in local currency, the standard entry-level wage range is higher than the prevailing local minimum wage. For Mosaic, minimum wages are generally not relevant since the majority of entry-level Mosaic positions require a higher level of skills or knowledge than jobs at which the minimum wage rate would apply.

| Comparing Mosaic’s Entry-Level Wage to Local Minimum Wage | |||

|---|---|---|---|

| Significant Operations | Local Minimum Wage | Mosaic Entry-Level Wages | Mosaic Entry-Level Wage Relative to Local Minimum Wage |

| U.S. Wage Range/hr (USD) |

$7.25–$8.25 | $13.40–$29.57 | 185% |

| Canada Wage Range/hr (CAD) |

$10.00 | $21.25–$36.81 | 213% |

| Argentina Wage Range/hr (ARS) |

22.50 | 58.07–87.70 | 258% |

| Brazil Wage Range/hr (BRL) |

3.31–5.59 Union* 3.29 National** |

3.52–8.02 Union* 3.29 National** |

106% Union* 100% National** |

| Chile Wage Range/hr (CLP) |

1093.75 | 2,672–5,142 | 244% |

| China Wage Range/hr (CNY) |

8.73–15.20 | 14.94–24.70 | 171% |

| India Wage Range/hr (INR) |

39.10–44.83 | 79.62–104.07 | 204% |

| Notes: (*) Excludes apprentice positions, paid at the national minimum wage (**) Applies to apprentice positions, paid at the national minimum wage |

|||

EC6

Policy, Practices and Proportions of Spending on Locally Based Suppliers at Significant Locations of Operations

| Local Supply Chain | |

|---|---|

| Operational Location | FY 2013 |

| All Phosphate (U.S. only) * | 75.91% |

| All Potash (Canada and U.S.) * | 62.03% |

| Offshore – Quebracho, Argentina ** | 100% |

| Offshore – Fospar, Brazil ** | 100% |

| Notes: (*) Excludes Governmental, Raw Materials, Clubs and Organizations, Employee Related and Freight spend, and includes as locals in the Phosphates business unit all vendors with addresses in Louisiana and Florida and in the Potash business unit all vendors with addresses in New Mexico, Michigan, Saskatchewan and Manitoba. (**) Argentina and Brazil figures are based on all spend and consider as local vendors all of those whose addresses are within these countries. Brazil total excludes Raw Materials. |

|

Mosaic does not have a written policy for preferring locally based suppliers, but we do encourage and support spend with local suppliers.

EC7

Procedures for Local Hiring and Proportion of Senior Management Hired From the Local Community at Significant Locations of Operations

As a matter of practice, and in accordance with Mosaic’s global job posting policies, we will “hire from within wherever possible.” For mid- to lower-level positions, a search is conducted locally to find a qualified candidate. If no local candidates are identified, then the search broadens until a qualified candidate is found. Mosaic provides a generous relocation package to support the movement of talent to our locations. For senior management roles, if no internal candidates are identified, a search will be conducted externally to find the best candidate for the leadership role. The hire may or may not come from one of the communities where we have a local presence. These candidates are also supported with relocation assistance.

Indirect Economic Impacts

EC8

Development and Impact of Infrastructure Investment and Services Provided Through Commercial, In-Kind or Pro Bono Engagement

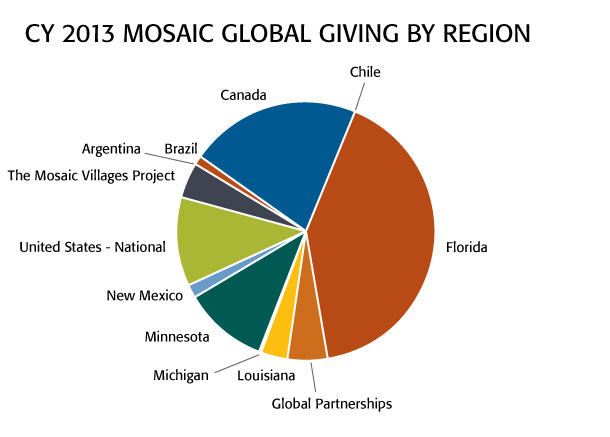

At Mosaic, our mission is to help the world grow the food it needs. As the world’s largest combined producer and marketer of concentrated phosphate and potash – two of the three macronutrients essential to plant life – this is both a business and social mission. We focus our community investments in three core areas that help us achieve this goal: Food, Water and Local Community Investments. Furthermore, our community investments are allocated to align with the size of our operations and industrial footprint in each of our locations. In fiscal 2013, combined contributions by The Mosaic Company, The Mosaic Company Foundation and The Mosaic Institute in Brazil through philanthropic funding, employee engagement and in-kind donations totaled approximately $27.16 million.

Additionally, Mosaic partners with the United Way, an important community nonprofit at Mosaic’s North American operations. Each fall, teams of employee volunteers organize a series of events that focus our employees’ attention on their communities through agency tours, volunteer projects and fundraising.

Since 2012, Mosaic has used an online grant system to track and monitor proposals for funding and report outcomes. Potential nonprofit partners can access the online grant system and the formal application for funding, our focus areas, our giving guidelines, our application deadlines and our non-discrimination policy through our Website. Establishing a standardized funding system, reporting outcomes and listing policies online provides greater transparency to our partners, shareholders, employees and communities.

Mosaic works closely with best-in-class nonprofit partners to address the needs of individuals and communities on issues ranging from local hunger relief, global food security, watershed restoration, nutrient stewardship and local civic needs in operating communities. A few examples of these partnerships are listed below.

Food

The Florida Association of Food Banks: Headquartered in Southwest Florida, the Florida Association of Food Banks (FAFB) is comprised of 14 regional food banks serving all 67 counties in Florida. In 2013, The Mosaic Company Foundation supported FAFB’s Farmers Feeding Florida program, which collaborates with Florida agricultural producers, packers and distributors to deliver fresh produce to Central and Southwest Florida food banks. These area food banks serve approximately 640 community agencies’ food shelves and food programs.

The Mosaic Villages Project: Initiated in 2008, the award-winning Mosaic Villages Project in India, Guatemala and eight African countries have helped more than 300,000 people move from food insecurity to food surplus. The Mosaic Villages Project is a physical manifestation of our mission to help the world grow the food it needs. Our investment includes cash grants, product, logistics, and the time and talents of many Mosaic employees, including agronomists who work alongside implementing partners in training farmers. In 2013, Mosaic invested more than $1 million in cash donations to The Mosaic Villages Project. In February 2013, Mosaic was awarded the President’s Excellence Award in philanthropy for The Mosaic Villages Project by CECP, formerly the Committee Encouraging Corporate Philanthropy.

Water

American Farmland Trust: Formed in 1980, American Farmland Trust (AFT) works to prevent the loss of farmland and promote environmentally sound farming practices. In 2013 Mosaic provided a grant to support AFT’s efforts on the Ohio River Basin Water Quality Trading Project, designed to improve water quality by helping farmers adopt conservation agriculture practices and participate in a first-of-its-kind interstate water quality trading market. In partnership with the Electric Power Research Institute, AFT identified and recruited farmers, educated stakeholders about water quality trading, and customized the application process for each state during the year.

The Nature Conservancy: Mosaic continues to support The Nature Conservancy’s Great River Partnership whereby the Conservancy has worked with local partners and producers to address nutrient and sediment runoff in agricultural landscapes located in five key watersheds. In 2013, The Mosaic Company Foundation provided funding that will help the Conservancy extend and expand work with farmers and partners to improve water quality in three watersheds in the Upper Mississippi River Basin: Minnesota’s Root River, Iowa’s Boone River and Illinois’ Mackinaw River.

Local

Habitat for Humanity: Mosaic has a strong partnership with Habitat for Humanity in Regina, Saskatoon, Moose Jaw and Yorkton, and in fiscal year 2013, Mosaic donated $1 million to the organization to build 68 new homes over a three-year period. In all, Mosaic has helped build more than 85 homes for at-risk families since 2008, directly impacting the low income housing shortage in the province. Mosaic employees continue to support builds, dedicating over 1,250 hours at builds, with over 120 employees lending a hand in the past year.

Child is Life: Through The Mosaic Institute in Brazil, Child is Life received funding to expand its Living Well Project, which provides health and self-esteem education to hundreds of children living in favelas, or shanty towns. Through schools and communities, the program trains teachers to administer curriculum on four topics: health and nutrition, physiology and respect for the human body, health and the environment, and decisions for better living.

The United Way

In 2013, 73% of Mosaic employees pledged a combined $1.73 million to 50 local United Way organizations across North America. With the Mosaic dollar-for-dollar match, the total amount donated to United Way in 2013 was over $4 million. Additionally, Mosaic was awarded the United Way Worldwide’s Summit Award for Corporate Philanthropy and the United Way Suncoast Spirit of Tampa Bay award.

Infrastructure Investments

Integrated Land Management Program (ILMP): Over the past 13 years, Mosaic has embarked upon an ambitious restoration initiative that includes an extensive exotics/nuisance plant removal program and planting of native species on its Riverview property. Mosaic is continuing the ILMP created as part of the Riverview phosphogypsum stack expansion project.

Compressed Natural Gas (CNG) filling station: Mosaic’s transportation partner in Central Florida, Dillon Transport, is building a CNG filling station to fuel CNG trucks used for Mosaic’s fleet. Trillium CNG will operate the plant. This is not public domain infrastructure, but it will be the first CNG station capable of accommodating heavy-duty trucks that is open to the public. The station is currently under construction.

EC9

Understand and Describe Significant Indirect Economic Impacts

Mosaic has diverse and varied indirect economic effects on communities across the world. However, due to the complex nature of the business and philanthropic activities in which Mosaic engages, Mosaic does not attempt to estimate its indirect economic impact by using a measurement of currency.

Global food security is one of the most pressing issues of our time and calls for the judicious use of resources, as well as an innovative spirit. Today’s crop nutrients are responsible for 40 to 60% of global crop yields, and Mosaic’s products play a crucial role in meeting the global demand for food. Our worldwide research programs focus on the development of new products for the specific soil characteristics in different parts of the world, such as Mosaic’s proprietary MicroEssentials® line, which is designed to help farmers make the most of every inch of farmland. By delivering sulfur and zinc with MicroEssentials and boron with Aspire™, another premium product, farmers are able to apply the top three most deficient secondary nutrients and micronutrients efficiently and uniformly, creating the opportunity to maximize yields in a sustainable manner.

Farmers who produce enough food to support a profitable business bring economic benefits through their hiring and spending practices. Likewise, the dealers who distribute our fertilizers and the vendors who support our operations are meaningful contributors to the economic vitality of the rural and regional communities where they operate. Additionally, participants in The Mosaic Villages Project receive no-interest loans to buy fertilizer at planting, and repay the loans through the sale of surplus yield at harvest. Fertilizer acts as an injection of capital to the region, helping farmers break the cycle of poverty that has gripped these developing regions of the world. Participants in The Mosaic Villages Project have reported that, on average, yields have increased three to five times over that of traditional farming practices. Furthermore, many of Mosaic’s charitable community investments are focused on supporting hunger relief in communities and providing access to emergency food systems. Studies show that children who have sustained hunger have reduced abilities and capacity to learn in school. Access to regular food improves educational outcomes.

The mining, production and distribution of potash and phosphate contribute to global economies through the import and export of the minerals themselves and the complementary goods needed to manufacture fertilizer, animal feed and industrial products. The multiplier effect of the money that Mosaic’s employees, suppliers and other stakeholders spend is dramatic. For example, in 2009, The Fertilizer Institute commissioned a study that found the phosphate fertilizer industry in the United States—of which Mosaic is the largest participant—provided a total economic contribution of $21.2 billion and almost 90,000 jobs.

Additionally, the Areawide Environmental Impact Statement (AEIS) for continued phosphate mining in the Central Florida Phosphate District that was administered by the Army Corps of Engineers studied the economic impact of Mosaic’s continued operations in the region. The evaluation included Employment, Labor Compensation, Value of Production or Output and Value Added. It concluded that the indirect economic impact of continued Mosaic mining in the Central Florida region over the next 50 years will be $1.4 billion. Furthermore, according to a 2013 study by the Port of Tampa of the port’s 2012 fiscal year, the phosphate industry accounted for more than $10 billion of the port’s $15.1 billion annual economic activity; supported more than half of the port’s 80,000 direct, indirect and related jobs; and created more than half of the 10,573 direct jobs at the port from the movement of phosphate rock and raw materials, as well as crop nutrition and animal feed supplies and products.

Through work with the United Way and other local charities, Mosaic’s community investments help families achieve greater economic independence and improve educational outcomes for children. From workforce development programs to K-12 education initiatives, communities receive significant support to advance results in our operating communities and in NGO partner programs globally.

Additionally, Mosaic’s partnerships with community organizations continue to support positive healthcare, education and housing opportunities for our neighbors. In Saskatchewan, Canada, Mosaic proudly supports Shock Trauma Air Rescue Service (STARS), which brings emergency medical transport to critically ill and injured patients in Saskatchewan. The service is the first of its kind in Saskatchewan, and with the largely rural communities in the regions where Mosaic operates, this program has already begun saving lives. After its first year in operation, over 250 lives were impacted due to the service. Mosaic also continues to support Habitat for Humanity in Regina, Saskatoon, Moose Jaw and Yorkton – helping to build 68 new homes over a three-year period.